Our First Free Data Friday: Exploring the World of Venture Capital

In an exciting new initiative to showcase the power of our data aggregation platform, we’re launching Free Dataset Friday, a weekly release of valuable datasets to help businesses, researchers, and entrepreneurs gain insights without the heavy lifting of data collection. Today, we’re thrilled to present our inaugural dataset: a comprehensive database of venture capital funds, complete with detailed information about their investment strategies, portfolio companies, and key operational metrics, and even contact information for individual investors.

About the Dataset

Our VC funds dataset offers an extensive look into the global venture capital ecosystem, featuring over 2,000 investment firms that specialize in Series A funding. These firms range from long-established players to emerging micro-funds. The dataset contains rich information including founding dates, investment counts, successful exits, investment focus areas, preferred funding stages, geographic presence, and digital footprints through website and social media links. As a bonus, the second sheet also contains the names and contact information from over 16,000 key players at these funds. This level of detail enables users to conduct sophisticated analyses of investment patterns, industry trends, and potential funding sources for entrepreneurial ventures.

What can you do with this Data?

Data Analysis and Visualization

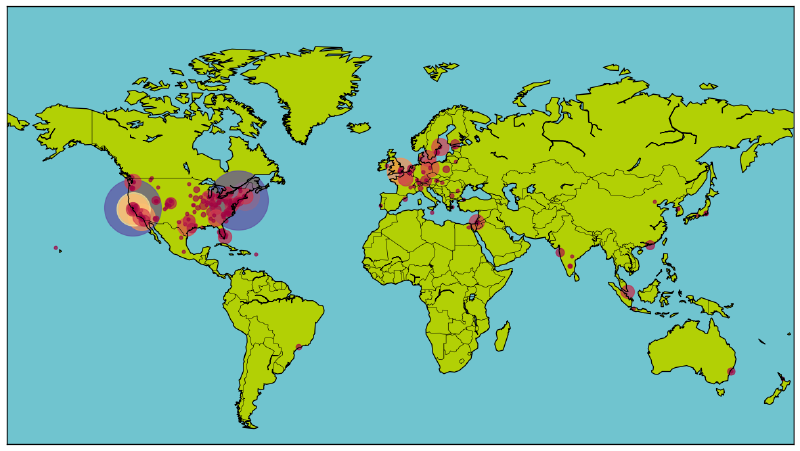

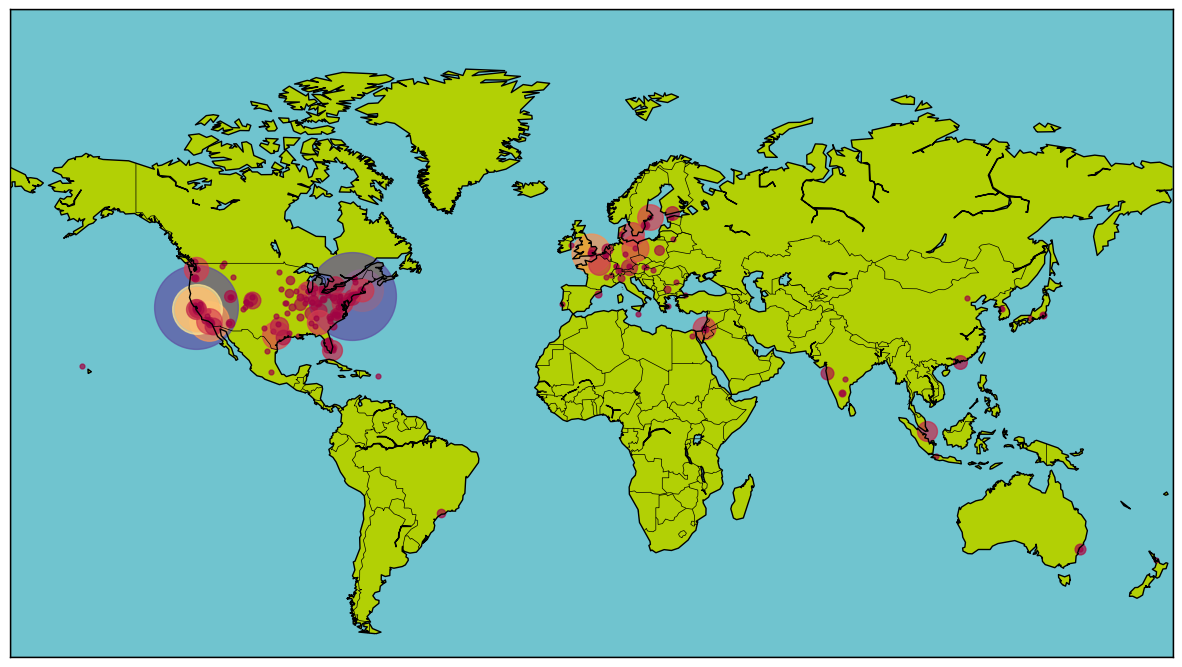

The visualizations provide a compelling look into the global venture capital landscape. The heatmap highlights the geographic distribution of VC fund locations, with clear clusters in major hubs like Silicon Valley, New York, London, and Berlin. These cities dominate the map, showcasing their central role in fostering innovation and investment. However, emerging hotspots in regions like Southeast Asia and parts of South America also stand out, signaling the globalization of venture capital activity.

The visualizations provide a compelling look into the global venture capital landscape. The heatmap highlights the geographic distribution of VC fund locations, with clear clusters in major hubs like Silicon Valley, New York, London, and Berlin. These cities dominate the map, showcasing their central role in fostering innovation and investment. However, emerging hotspots in regions like Southeast Asia and parts of South America also stand out, signaling the globalization of venture capital activity.

The word cloud offers a snapshot of the investment focus areas for these funds. Terms like “Artificial Intelligence,” “Machine Learning,” “Big Data,” and “E-Commerce” appear prominently, reflecting the tech-driven nature of modern venture capital. Emerging trends such as “ClimateTech,” “Health & Wellness,” and “FinTech” also make a strong showing, indicating growing interest in sustainability, healthcare innovation, and financial technology.

Turning the Data into Actionable Insights

These data-driven visualizations are more than just eye-catching graphics—they provide actionable insights for entrepreneurs and investors alike. For founders, the heatmap can guide strategic decisions about where to establish or expand operations based on proximity to active VC hubs. Meanwhile, the word cloud reveals where investment dollars are flowing, helping startups align their pitches with trending focus areas like AI or ClimateTech.

For venture capital firms, this data can inform competitive analysis and portfolio diversification strategies. Firms can identify underserved regions or emerging industries ripe for investment. By leveraging these insights, both startups and investors can position themselves to capitalize on the evolving dynamics of the global innovation ecosystem.

How We Built This Dataset

Creating this comprehensive venture capital database demonstrates the power of the Gumbo platform. Our system can efficiently collect and structure information from thousands of public sources, including company websites, press releases, and social media profiles.

What would typically require weeks of manual research and organization by a team of analysts can be accomplished in hours using our automated data pipeline. The platform handles the surfacing and structuring of data so you can focus on analyzing and acting on it.

Conclusion

This venture capital funds dataset represents just one example of the high-value, structured information our platform can extract from the internet for business intelligence purposes. By releasing it freely, we aim to demonstrate both the quality of our data aggregation capabilities and our commitment to fostering a more transparent, accessible business information ecosystem. We invite you to download this dataset and explore the venture capital landscape for yourself.

Our platform makes creating similar datasets for your specific industry or research needs remarkably straightforward. Whether you’re seeking competitive intelligence, tracking market trends, or exploring partnership opportunities, Gumbo makes it effortless.

Join us next Friday for another free dataset release, and discover how our platform can empower your organization with comprehensive data resources that drive better business decisions.